Our Hsmb Advisory Llc Statements

Our Hsmb Advisory Llc Statements

Blog Article

6 Easy Facts About Hsmb Advisory Llc Described

Table of Contents6 Simple Techniques For Hsmb Advisory LlcNot known Facts About Hsmb Advisory LlcHsmb Advisory Llc - TruthsThe 5-Minute Rule for Hsmb Advisory LlcThe Hsmb Advisory Llc PDFs8 Simple Techniques For Hsmb Advisory Llc

Ford claims to steer clear of "cash money value or permanent" life insurance policy, which is even more of a financial investment than an insurance. "Those are extremely made complex, featured high compensations, and 9 out of 10 people do not need them. They're oversold since insurance policy agents make the biggest commissions on these," he says.

Handicap insurance can be pricey. And for those who opt for long-lasting treatment insurance policy, this policy might make impairment insurance coverage unneeded.

Indicators on Hsmb Advisory Llc You Need To Know

If you have a chronic health and wellness concern, this kind of insurance coverage can wind up being essential (Insurance Advise). However, do not allow it emphasize you or your financial institution account early in lifeit's usually best to take out a plan in your 50s or 60s with the expectancy that you will not be utilizing it up until your 70s or later.

If you're a small-business owner, think about protecting your income by buying organization insurance policy. In the occasion of a disaster-related closure or period of rebuilding, business insurance can cover your revenue loss. Take into consideration if a substantial weather condition event affected your store front or manufacturing facilityhow would that impact your income? And for the length of time? According to a report by FEMA, in between 4060% of small companies never reopen their doors adhering to a catastrophe.

And also, using insurance policy might in some cases cost even more than it saves in the lengthy run. If you get a chip in your windscreen, you might think about covering the fixing cost with your emergency situation financial savings instead of your vehicle insurance policy. St Petersburg, FL Health Insurance.

Facts About Hsmb Advisory Llc Uncovered

Share these ideas to shield enjoyed ones from being both underinsured and overinsuredand seek advice from a relied on expert when needed. (https://allmyfaves.com/hsmbadvisory?tab=HSMB%20Advisory%20LLC)

Insurance that is bought by a specific for single-person protection or coverage of a family members. The private pays the premium, rather than employer-based medical insurance where the employer frequently pays a share of the costs. People might purchase and acquisition insurance policy from any type of strategies readily available in the individual's geographical area.

Individuals and households may get monetary support to reduce the cost of insurance policy premiums and out-of-pocket expenses, yet only when signing up via Attach for Health Colorado. If you experience particular modifications in your life,, you are qualified for a 60-day duration of time where you can register in a private plan, even if it is beyond the yearly open enrollment period of Nov.

Some Ideas on Hsmb Advisory Llc You Need To Know

- Link for Health And Wellness Colorado has a complete listing of these Qualifying Life Events. Dependent you could try these out youngsters that are under age 26 are eligible to be included as member of the family under a moms and dad's coverage.

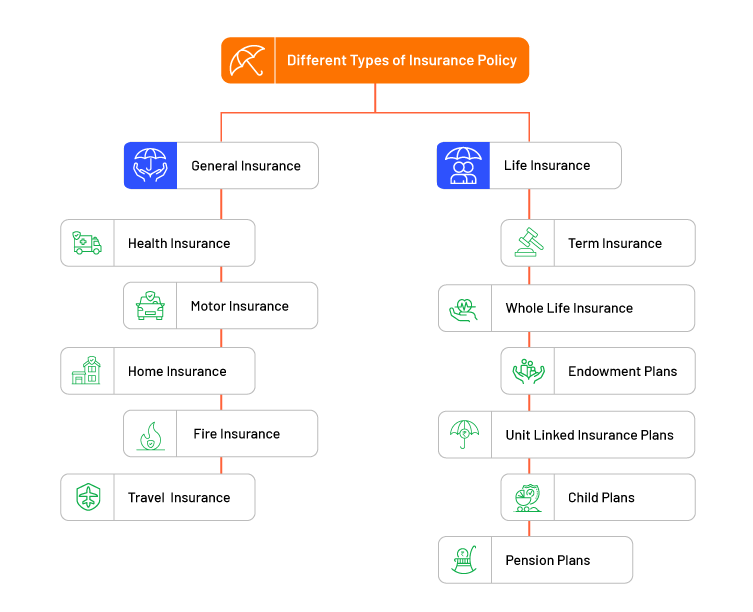

It might seem easy however comprehending insurance coverage kinds can also be confusing. Much of this complication comes from the insurance sector's ongoing objective to make customized insurance coverage for insurance policy holders. In making adaptable plans, there are a selection to choose fromand all of those insurance policy types can make it tough to recognize what a particular plan is and does.7 Easy Facts About Hsmb Advisory Llc Described

If you die throughout this duration, the individual or people you've named as recipients might get the money payment of the plan.

Many term life insurance policy plans allow you transform them to an entire life insurance policy, so you do not shed protection. Typically, term life insurance coverage plan costs payments (what you pay monthly or year into your policy) are not secured in at the time of purchase, so every five or 10 years you have the plan, your costs can increase.

They also have a tendency to be less expensive general than whole life, unless you purchase an entire life insurance policy policy when you're young. There are also a couple of variations on term life insurance coverage. One, called team term life insurance policy, is typical among insurance coverage alternatives you may have access to via your employer.Unknown Facts About Hsmb Advisory Llc

One more variant that you may have accessibility to via your company is additional life insurance policy., or funeral insuranceadditional coverage that can help your family members in case something unexpected takes place to you.

Irreversible life insurance coverage just describes any type of life insurance policy that does not run out. There are a number of sorts of irreversible life insurancethe most usual types being whole life insurance coverage and global life insurance coverage. Whole life insurance policy is precisely what it seems like: life insurance coverage for your entire life that pays out to your recipients when you pass away.

Report this page